Keywords: Fixed income securities, government bonds, corporate bonds, CDs

1. Fixed income securities definition:

Fixed income securities are financial instruments where investors offer capital (principal) to its issuer for exchange that the issuer will make periodic payments of fixed interests in addition to the eventual return of the principal when the security reaches maturity.

- Principal: the amount of money issuer promises to pay the investor when the bond reaches its maturity

- Maturity: the time when the bond expires.

Types of fixed income securities:

There are three common types of fixed income securities: (1) government bonds, (2) corporate Bonds, (3) certificate deposits (CDs).

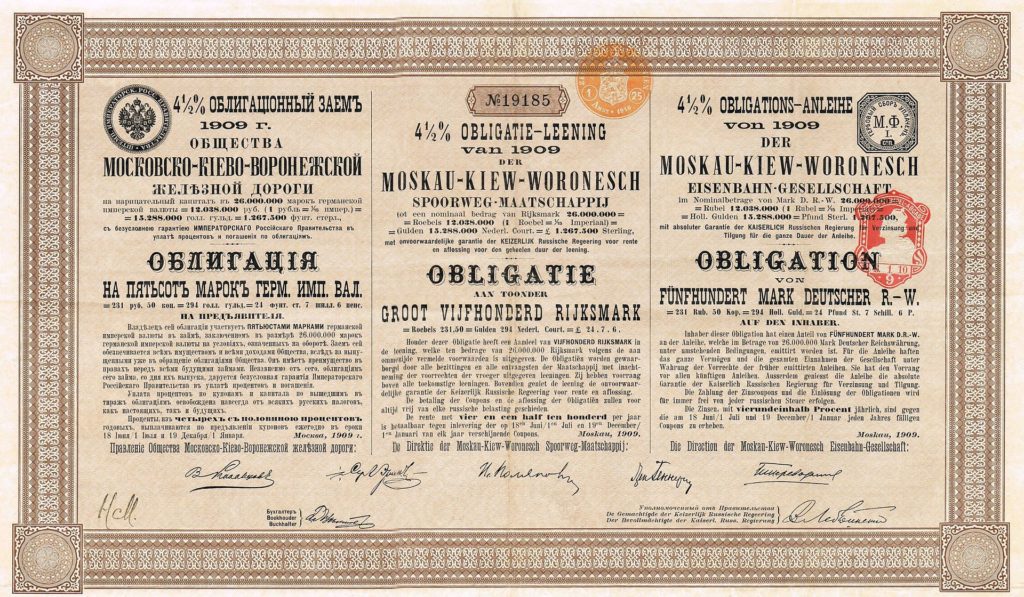

2. Government bonds

Definition:

A government bond is a fixed income securities issued by a government to support government spending. It generally consists of (1) coupon payments and (2) face value.

- Coupon payments: the issuer’s obligation to pay fixed periodic interest

- Face Value (Par Value): Face value, or called par value, is literally the principal of the bond.

Explanation with an example:

An investor spent $20,000 (face value) to purchase a 5-year (maturity) government bond with a 10% annual coupon.

In this scenario, the government will pay the investor 10% of the $20,000 every year (annual coupon) and return the original $20,000 when the bond reaches its maturity in the end of the fifth year.

Examples of Government Bonds:

- Treasury Bills (T-Bills)

- Treasury Notes (T-Notes)

- Treasury Bonds (T-Bonds)

One of the cheapest VPN providers

3. Corporate bonds

In contrast to government bonds, corporate bonds are issued by companies. Investors who purchase corporate bonds provide capital to the company in exchange for the its legal commitment to pay periodic interest and return the principal when the bond matures.

Default risks: risks compared to government bonds

Government bonds carry very low risk since they are backed up by the government. In other words, unless the government that issues the bond collapses, things are fine.

However, the investors of the corporate bonds need to concern about the default risk of the company that issues the bond since corporate issuers may fail to make timely payments of interest or default on principal.

Legal obligations: risks compared to common stocks

The company owns different legal obligations when it encounters financial difficulties, or runs into bankruptcy.

A company does not bear any legal obligation to pay its shareholders any dividends in the time of financial difficulties. Nonetheless, its legal obligation to make timely payments of interest and principal to its bondholders sustains in that situation.

Q1: Do I own equity in the company if I purchase corporate bonds?

A: No, you don’t. You will only receive interest and principal on the bond.

Q2: Will I receive dividend s of the company if I purchase corporate bonds?

A: No, you don’t. You will only receive interest and principal on the bond.

Q3: Do I receive higher interest if the company’s stock price climb?

A: No, you don’t. You will only receive fixed interest regardless of the company’s performance

Bankruptcy

When a company runs into bankruptcy, its bondholders have priority over its stockholder in claims on the company’s assets and cash flows.

3. Certificate Deposits (CDs)

Definition :

A certificate deposit (CD) is a financial products where investors leave a deposit in a bank (or credit union) untouched for a fixed period of time. In return, the bank (or credit union) gives the investor an interest rate premium.

- Credit unions: a type of non-profit financial institution similar to commercial banks

- Premium: monetary rewards

Maturity:

The money deposited in CD accounts are expected to be held by banks until maturity. In other words, the deposits in most cases can only be withdrawn at maturity.

Financial institutions normally offer higher interest-rates for CDs than saving accounts due to the fact that the money deposited in the CD accounts generally cannot be withdrawn on demand.

Virtually Risk Free:

In the United states, CDs issued by banks are insured by the Federal Deposit Insurance Corporation (FDIC); CDs issued by credit unions are insured by the National Credit Union Administration (NCUA) for credit unions.